Dive Brief:

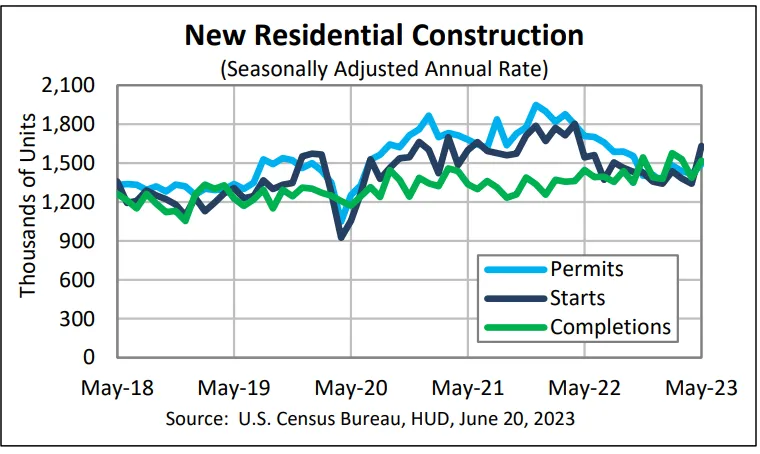

- Despite problems in the financing world, multifamily starts in buildings of five or more units jumped 40% year over year in May to a seasonally adjusted annualized pace of 624,000, according to the most recent starts data report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

- Overall, privately owned housing starts rose 5.7% to a seasonally adjusted annual rate of 1.6 million units in May. However, single-family starts fell 6.6% YOY.

- While apartment developers are still getting projects out of the ground, they are not pulling permits for new deals at the same pace. Multifamily permits fell 11.9% to an annualized pace of 542,000. Single-family home permits dropped 13.2% to a 897,000 annualized rate in May.

Dive Insight:

One of the great mysteries in the market right now is why apartment starts continue to rise in the face of an increasingly difficult financing environment for apartment developers. But that may soon be changing, as shown in the permit numbers.

Ric Campo, CEO of Houston-based REIT Camden Property Trust, said starts continue to be elevated because developers are breaking ground on legacy projects where they already have capital commitments in place from banks and equity partners.

“I just think that developers are crafty enough to keep their legacy deals in place, and that's why you haven't seen a dramatic falloff in starts,” Campo said on Camden’s most recent earnings call.

But Campo expects the Federal Reserve’s interest rate hikes, combined with recent banking failures, to reduce new starts. Overall, he’s betting on a 60% reduction in new developments this year and a slowdown that possibly lasts into 2025.

“Second- and third-tier developers are not getting their deals done,” Campo said.

Right now, it may be easier for established or bigger developers to get financing, though construction debt is also getting more difficult for them to find.

“It’s certainly not like it was the last few years before things started slowing last year,” said Matt Enzler, senior managing director for the North Texas division of Dallas-based developer Trammell Crow Residential, the nation’s No. 5 largest builder in 2022, according to the National Multifamily Housing Council.

Until things stabilize, new starts will continue to be under pressure, Campo said.

“While developers will always build if they have capital, right now, both the equity and the debt markets are saying, ‘Well, let's try to figure out what happens in the future,’” he said.

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.