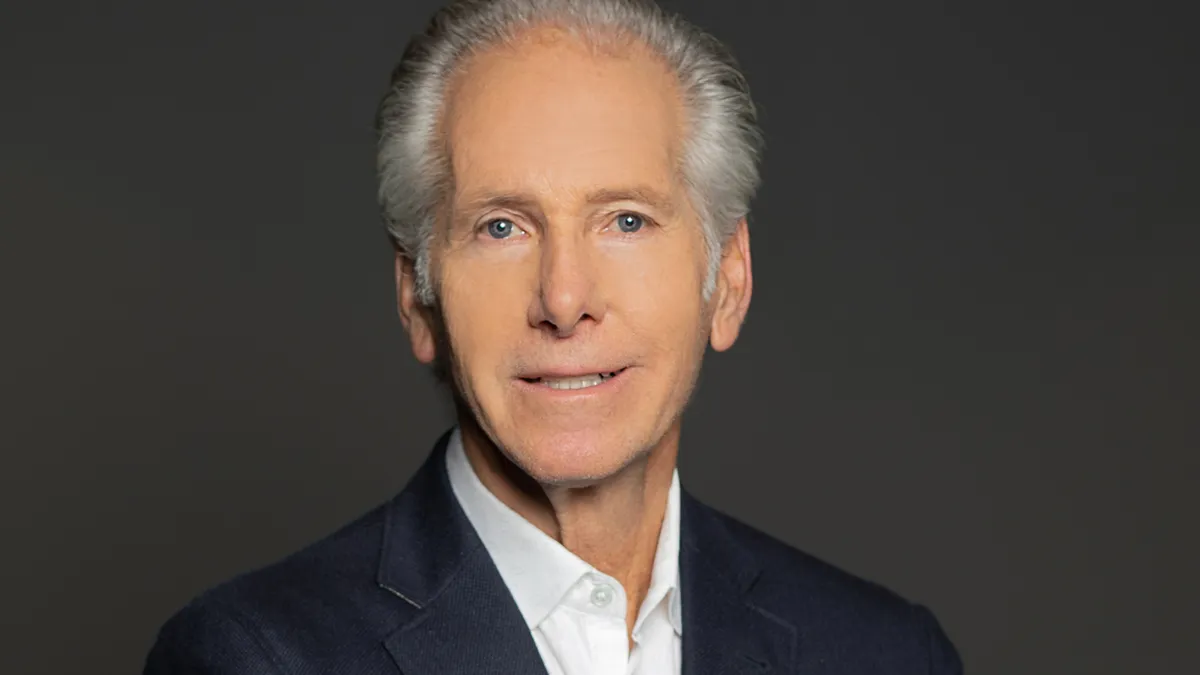

Eagle Property Capital, a Miami-based real estate investor specializing in workforce housing, has announced that Barry Chase has joined the company’s leadership team as a partner and managing principal.

Chase, a 40-year veteran of the multifamily industry, has left semi-retirement for his new role at EPC, according to company spokesperson Melinda Sherwood. In his new role, Chase will co-lead the company’s strategy and execution, develop institutional relationships, contribute to investment committee decisions, mentor senior management, enhance investment procedures and contribute to new products.

“Barry brings an unparalleled depth of knowledge and a proven track record in managing discretionary institutional capital to Eagle Property Capital,” said Rodrigo Conesa, co-founder and managing principal of EPC, in the news release. “We believe his highly disciplined approach to investing and fiduciary mindset will amplify our position as a trusted partner to institutional investors seeking a seasoned multifamily operator and investment manager.”

Before joining EPC, Chase was one of the founders of Sherman Oaks, California-based Belay Investment Group, as well as its former CEO and executive chairman. Belay specializes in small- to middle-market real estate opportunities with local operators, including EPC, which Chase has worked closely with over the past eight years, according to the company.

Chase has also held senior executive positions at Irvine, California-based Koll Development, Los Angeles-based Cushman Realty Corp., now a part of New York City-based Cushman & Wakefield and Newport Beach, California-based CT Realty. He has made investments on behalf of large pension funds and institutional investors, and directed more than $3.5 billion in transactions over the course of his career.

Since its founding in 2011, EPC has acquired, repositioned and managed over 10,400 units across 42 properties in the Southeastern U.S., with a focus on high-growth cities in Florida and Texas. It has over $1.1 billion in assets under management.

EPC recently closed its fifth investment fund with $325 million in equity commitments, which it has invested in value-add properties in high-growth Sun Belt markets, according to the release. The company plans to open its next investment vehicle this year.

“As we prepare to launch our sixth multifamily investment fund, Barry’s expertise strengthens EPC’s senior leadership team in a complex investing environment filled with opportunities and challenges,” said Gerardo Mahuad, co-founder and managing principal of EPC. “The multifamily market has very attractive long-term fundamentals, and we’re optimistic about the investment opportunities in 2025 and beyond.”