This year, a lot of deals in Houston and other once-hot Texas markets began to run into issues as inexperienced operators, rising supply and increasing expenses combined to make apartment operations in the state increasingly difficult.

But Sandy Schmid, director of acquisitions and development for Beverly Hills, California-based StarPoint Properties, still sees opportunities in the Lone Star State, provided they’re in the right location, with Dallas-Ft. Worth emerging as a promising target.

From April 2018 to April 2023, the metro area gained more than 550,000 jobs, ranking first in the nation for job growth and double that of the second and third place in Atlanta and Phoenix, according to a report from Truist Bank and the Dallas Regional Chamber of Commerce.

“In a relatively short time, the DFW market has transformed itself from a solid second-tier city to a preeminent tier-one market,” Schmid told Multifamily Dive. “Part of what I see there is a massive diversification of the economy and job growth.”

Schmid sees a lot of “interesting pockets” around DFW where deals could become available. But there are some near-term concerns.

“There are a lot of units in the pipeline, and that’s going to work against rent growth,” Schmid said. “But, if you've got a good property in the right pocket, you may not feel those pressures of additional supply as acutely.”

In Austin, on the other hand, there is a lot more supply as a percentage of existing apartment stock coming online, which can limit rent growth and occupancy. “It doesn't have the same economic diversification that the DFW market does,” Schmid said, though he thinks trade with Mexico could diversify the job base in Austin.

Here, Schmid talks with Multifamily Dive about potential buying opportunities in Texas, incomplete development deals and the potential for distress.

This interview has been edited for brevity and clarity.

MULTIFAMILY DIVE: How much in acquisitions are you targeting for 2024?

SANDY SCHMID: We'd love to deploy roughly $100 million in total capitalization. That would be an ideal scenario for 2024. We're not going to force acquisitions just to stick to a business plan. We're not going to stress our investor relationships just to get a deal done. So, we're making sure that we're finding the right opportunity.

Where will the opportunities be coming from next year?

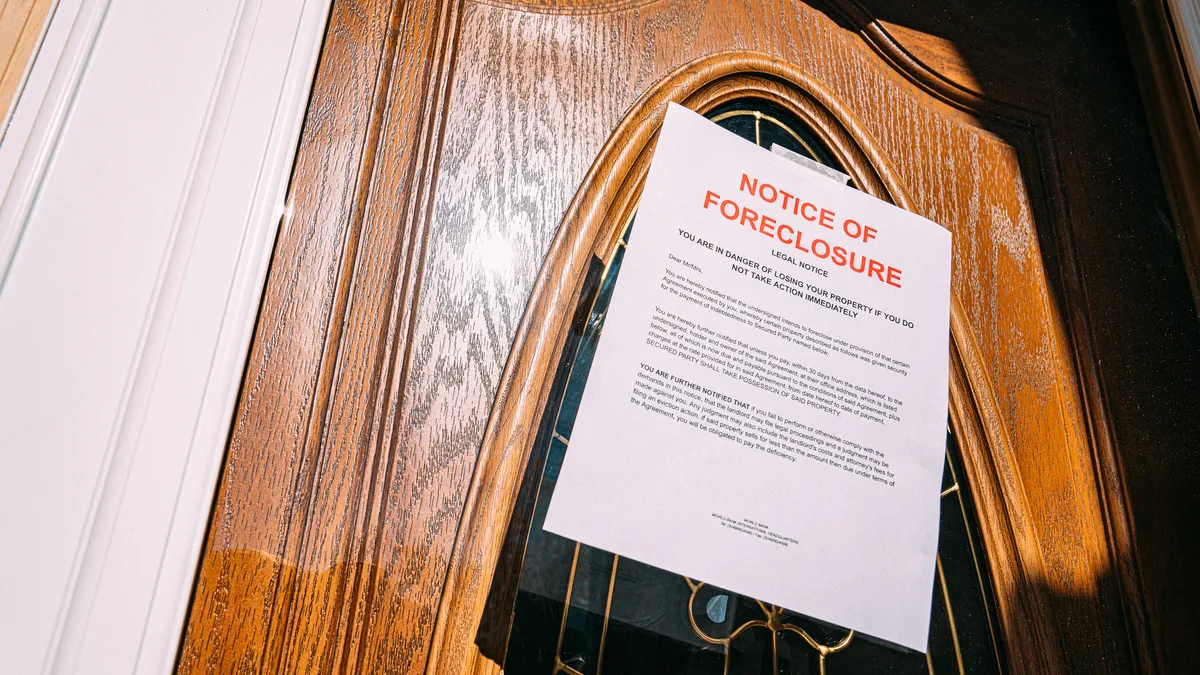

There are probably three core archetypes of buying opportunities. No. 1 is a capitalization issue where there's a need to call in capital. Maybe it's a syndicator who can’t make a capital call, and that forces a sale. That's really a problem in the capital stack.

Another problem is under-management, and then there's an opportunity to institutionalize the property operations and make things right. That could happen with a mom and pop, and that can happen with a syndicator.

And then the last one, we’re putting on our developer hat, and we are looking for incomplete construction. The developer ran out of money and the deal needs to be recapitalized. Whether it's real estate owned or a note sale, there needs to be new ownership.

Do you see more incomplete development deals hitting the market?

I haven't seen a lot today, and I wouldn't expect to see a ton. I think it's going to be more episodic than systemic going forward. So it's just all the more reason you've got to really be active in the market and be there at the right place and time.

What will happen to open up deal flow next year?

I think buyers are going to get a little bit more aggressive on their cap rate requirements as we see a settlement in interest rates and interest rate expectations. There will be a meeting in the middle between buyers and sellers. It's not going to be a story of total capitulation of sellers.

And at the same time, the buyers are not going to rush back into pre-interest-rate hike cap rates. They'll find consensus.

Do you see a lot of distress situations popping up?

The speculation about loan maturities probably gets overhyped. Things are never as bad or as good as the headlines suggest. I remember in the global financial crisis, there was a lot of distress, but it wasn’t as bad as some predicted. I would say the same will happen here because we still have a very solid economy.

Unemployment is still historically low. We still have job creation. The economy continues to surprise with its resilience. So I don't think it's going to be as bad as people think it might get. I think this rising tide of the economy is going to really soften the loan maturity risk that we're looking at for 2024.

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.