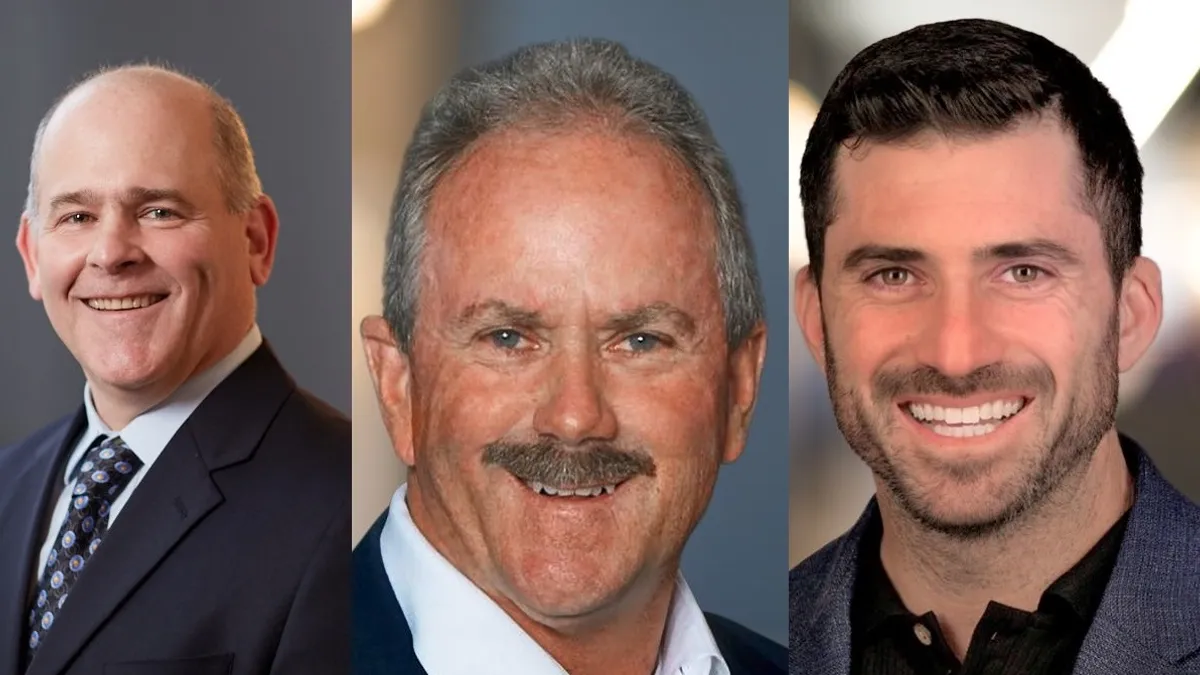

St. Louis-based student housing developer Subtext is expanding its reach. The company recently began acquiring existing student properties, and brought on multifamily veteran Mike Hung as partner and executive vice president of acquisitions.

"Mike is the perfect leader for our latest venture, bringing extensive expertise in deal sourcing, strategy and structuring, which is crucial for launching Subtext's acquisition platform,” said Brandt Stiles, co-founder of Subtext, in a press release.

Hung, based in Charlotte, North Carolina, has transacted on more than $1 billion in student housing assets throughout his 15-year career in the industry. He has worked as senior vice president of acquisitions for CA Ventures’ student housing platform, CA Student Living, and has also held positions at Wells Fargo, BlackRock and Waypoint Residential, where he launched a new student housing division. Most recently, he founded Citrine Partners, a multifamily investor focused on student housing at top universities.

In his new role, Hung will oversee the new platform’s launch, as well as oversee all aspects of property acquisition, including deal sourcing, strategy and structuring.

“This strategic move is aligned with Subtext's long-term vision of becoming a premier, vertically integrated real estate operator,” Stiles added. “While the acquisitions vertical is a new addition to Subtext's portfolio, it is a logical next step in the company's evolution. I am confident in our ability to identify and secure properties aligned with our vision as we merge Mike's expertise with our unique, data-driven approach.”

Outside of its new acquisitions arm, Subtext develops and builds both student and traditional multifamily housing, with projects largely concentrated in the Midwest. The firm has $1.7 billion in projects in the development pipeline, and its finished projects house over 7,000 students, according to its website.

“We’re really focused on high-growth secondary markets,” Marina Malomud, partner and chief operating officer of Subtext, told Multifamily Dive. “So that has been markets like Boise, Idaho; Phoenix; Tampa; Nashville; Denver. We’re really focused on the Southeast and Mountain West.”